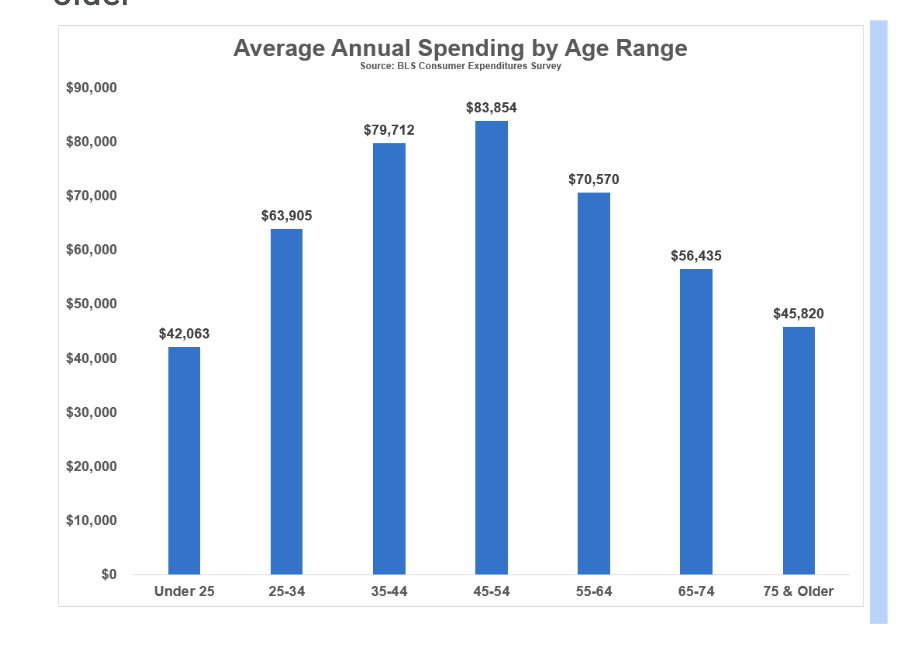

Average spending between 65-74 and 75 Plus drops about 20%. This is off an even steeper decline from 55-64. The data bears this out. People spend less as they age.

Two: Assuming that our spending will be linear or equal throughout retirement will effectively reduce your quality of life early in retirement when you’re likely in better health.

We know from our parents and watching others that people slow down over time. We naturally do less as health invariably throws a monkey wrench into our day to day lives.

Think about it this way.