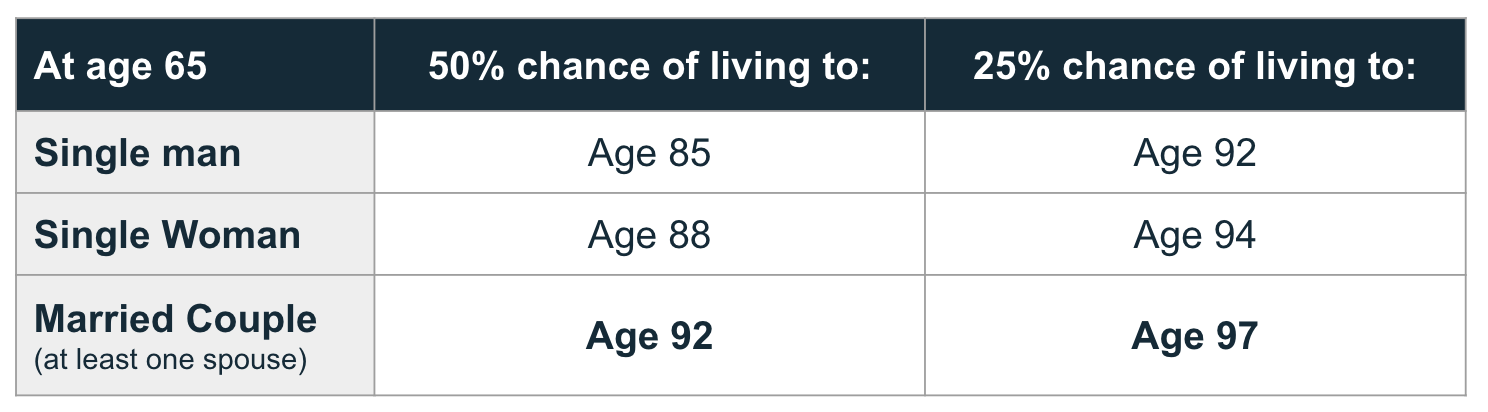

Is time really on your side? (It may be...)

I draw two lessons from these numbers:

- Make sure your retirement plan is “long” on longevity. My software defaults to the early 90’s and I don’t change it for anyone!

- Make sure your essential monthly expenses are covered.

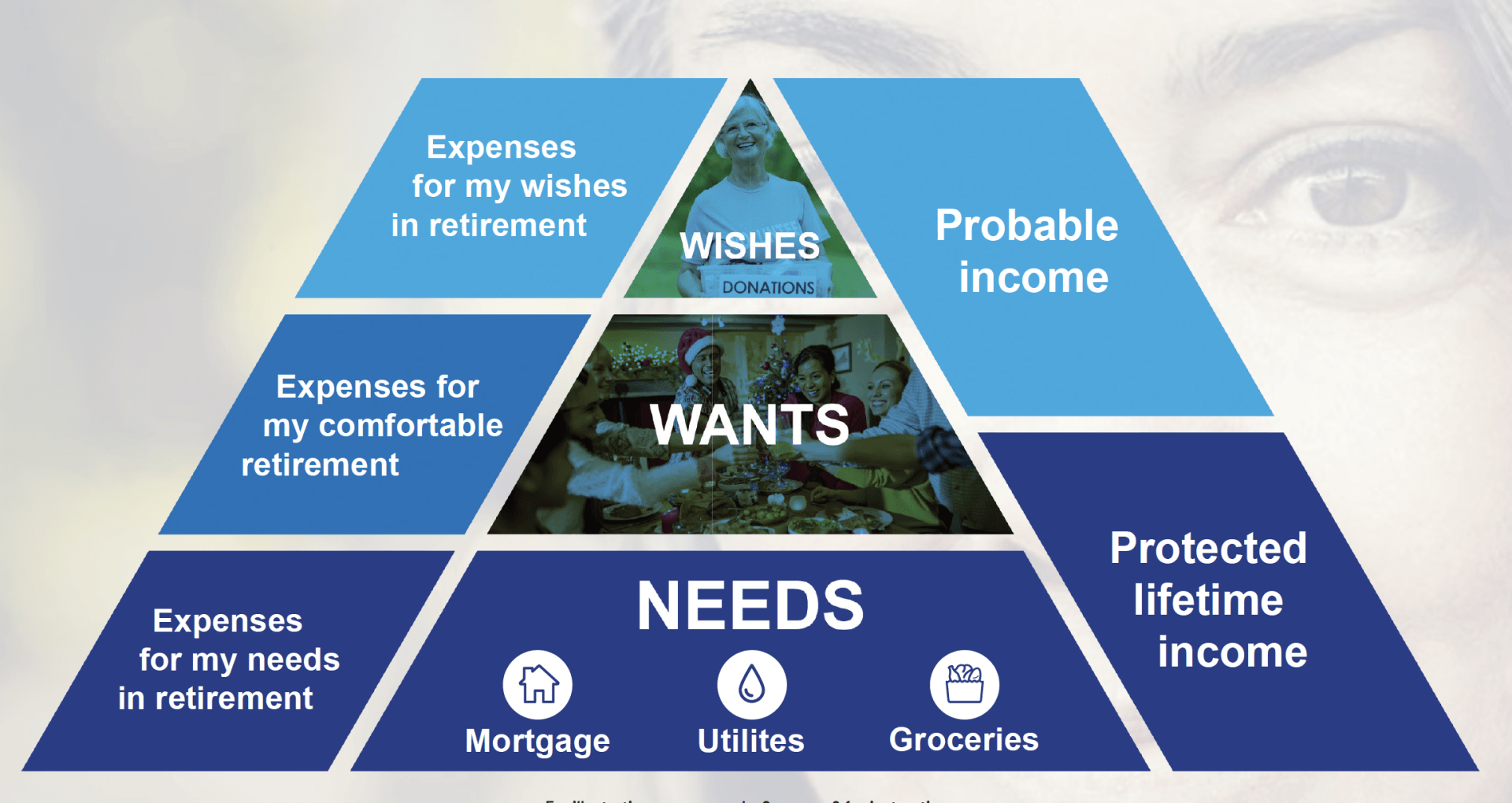

When you have your essential monthly expenses covered, you can live life the way you want in retirement.

A good retirement income plan is the foundation of financial security.

Think about it this way: Your needs and most of your wants should be covered by some sort of clearly defined income source. There are many options. The image below will give you a visual representation.

List your non-negotiables on the bottom. List your wants - or your “comfort money” in the middle tier. You can list your wishes or dream money on the top level.

Basic expenses like housing and utilities will be top of mind. But don’t forget “what-ifs” like boomerang children - those who return to the nest - or things like entertainment and bucket list items. I don’t want to tour America in a motorhome but maybe you do!

Ask yourself, “Does my plan ensure I have enough money to live as I want and as long as I can?”

You might also like

Contact us

We will get back to you as soon as possible

Please try again later

KEEP IN TOUCH

Sign up and get all info you need to create financial safety, simplicity and STRENGTH in retirement!

Sign up to our newsletter

Thank you for contacting us.

We will get back to you as soon as possible

Oops, there was an error sending your message.

Please try again later

Business Info

Address: 1821 Walden Office Square, S-400, Schaumburg, IL 60173

Phone: 312-617-8936

Email: darryl@MySECURiMENT.com

Make An Appointment

Investment advisory services offered through Brookstone Capital Management, LLC (BCM), a registered investment advisor. BCM and Rose Advisory Group are independent of each other. Insurance products and services are not offered through BCM but are offered and sold through individually licensed and appointed agents. The content of this website is provided for informational purposes only and is not a solicitation or recommendation of any investment strategy. Investments and/or investment strategies involve risk including the possible loss of principal. There is no assurance that any investment strategy will achieve its objectives. Fiduciary duty extends solely to investment advisory advice and does not extend to other activities such as insurance or broker dealer services. Advisory clients are charged a monthly fee for assets under management while insurance products pay a commission, which may result in a conflict of interest regarding compensation. Any comments regarding safe and secure investments, and guaranteed income streams refer only to fixed insurance products. They do not refer, in any way to securities or investment advisory products. Fixed Insurance and Annuity product guarantees are subject to the claims‐paying ability of the issuing company and are not offered by BCM. Index or fixed annuities are not designed for short term investments and may be subject to caps, restrictions, fees and surrender charges as described in the annuity contract.

All Rights Reserved | SECURiMENT™ Wealth Management